Financial Fears: The Battle for Economic Freedom Against Centralized Control

- Cypher Funk

- Jul 8, 2024

- 18 min read

Prepare to confront the unsettling truths about the forces shaping our economy and the relentless battle for a truly decentralized financial future. As you delve deeper, you will find that in the shadow of towering financial institutions and imposing government edifices, the promise of economic freedom and personal autonomy offered by cryptocurrencies stands on precarious ground, facing an existential threat.

Recent events in 2024 have only amplified these fears. The specter of geopolitical tensions, the relentless march of inflation, and the volatile swings in interest rates orchestrated by powerful entities remind you of the fragility and vulnerability inherent in our current financial system.

Historical crises, such as the collapse of Mt. Gox, linger as stark reminders of the systemic risks and the heavy-handed regulatory responses that often follow. At this critical juncture, as you witness the tightening grip of governmental control, it becomes imperative to scrutinize the true beneficiaries of these policies and question the long-term consequences on your financial freedom and market integrity.

This article delves into the heart of these issues, exposing the tensions between centralized economic control and the ethos of decentralization that cryptocurrencies embody. By examining the recent and historical influences of political and financial control, you will unveil the stark realities of a system designed to perpetuate power and suppress dissent.

The Political Landscape Shaping Economic Policies

Recent Events in 2024

The year 2024 began with a torrent of political developments roiling global markets. In America, the Federal Reserve's ongoing struggle weighing inflation restraint against economic growth sparked fierce disputes about soundness and development. Concurrently, geopolitical stresses were exacerbated by protracted trade clashes between the U.S. and China, amplifying volatility.

Across Europe, languid progression paired with stubborn inflation plagued the Eurozone. The potency of European Central Bank policies soothing these issues came under intense examination, confronted by the opposing demands of member nation administrations. Elsewhere, the United Kingdom grappled with post-Brexit accommodations as lofty expenses and diminished certainty darkened their financial projection. Meanwhile, fraught trade discussions between America and China continued to inflame global financial tensions as regional powers jockeyed for economic and strategic influence.

In Asia, the political landscape remains intricately complex with many longstanding issues shaping regional dynamics and new challenges continually emerging. China, traditionally a key driver of global economic growth, now faces a constellation of domestic concerns including an aging society, mounting youth unemployment, and slipping productivity. These difficulties are exacerbated by China's stringent regulatory environment which has cast a chilling pall over both domestic and international business investments. Meanwhile, shifting political currents in Southeast Asia, especially in countries such as Indonesia, actively influence nearby economic policies and alliances while redirecting trade and investment flows across the continent.

Historical Developments

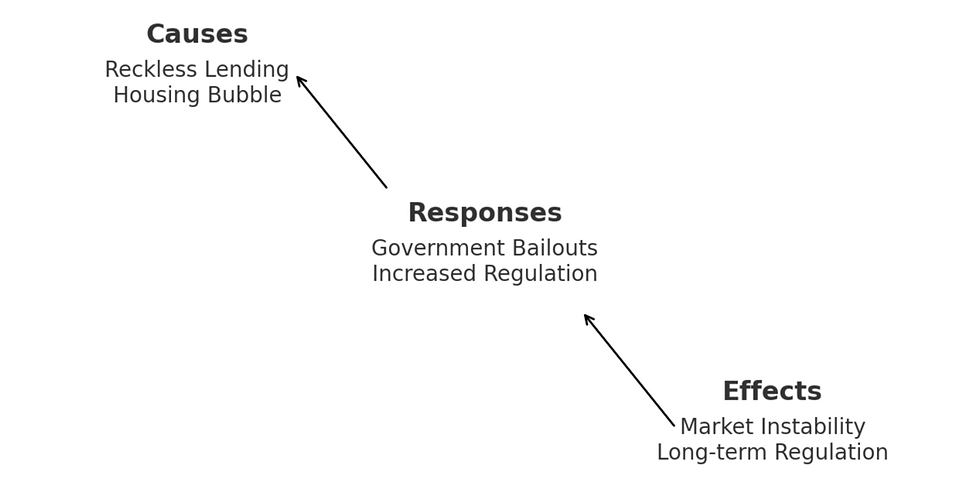

The political implications surrounding economy are best understood through retrospect of landmark occurrences shaping fiscal policy. The 2008 worldwide fiscal emergency offers prominent reminder. Toppling titans of trusted banking combined with housing market crash precipitated disaster, governments reacted with unparalleled action: flooded failing firms with funds, spurring spending aimed at avoiding deeper dive. Though staving off swift sinking satisfied immediate needs, such sizable support forged troublesome tendency risking reliance on administration administered aid and acquiescence of budgets ordinarily operating outside official oversight. Amid alarms of amplified authorities administrators potentially posing problems down the line, questions linger as to long term effects on market mechanics meant to function independent of involvement.

In the aftermath, central banks worldwide embraced aggressive monetary policies including quantitative easing and zero or negative interest rates. Intended to spur recovery, these actions also bred increased market reliance on central bank interventions. This environment of sustained low interest rates fueled asset bubbles and ballooning debt levels, generating fresh risks to worldwide economic stability.

Another pivotal episode profoundly shaping our current economic environment was the regulatory response to cryptocurrencies' ascension. When Mt. Gox, once Bitcoin's largest exchange globally, fell apart in 2014, it unveiled weaknesses within the crypto market, resulting in demands for stricter monitoring. Since then, governments worldwide instituted an eclectic mix of actions supposedly aimed at containing perceived risks related to digital monies, though often these smothered invention and capped the crypto sphere's growth potential. Simultaneously, a small yet growing group of visionaries sought to advance applications of the distributed ledger technologies underlying cryptocurrencies, aiming to demonstrate benefits like expanding access to financial systems and streamlining supply chain operations, yet regulatory hurdles loomed large.

By scrutinizing these current and historical happenings, it becomes evident how political determinations and regulatory activities mold the financial environment, often prioritizing stability and authority over innovation and freedom of choice. As we navigate through the year 2024, the interplay among these forces will carry on to characterize the trajectory of both traditional and decentralized monetary markets. Furthermore, the lasting consequences of laws written amid volatility remain to be seen as new technologies challenge old paradigms.

Governmental Control and Economic Manipulation

Central banks such as the Federal Reserve hold extensive influence over economic conditions through interest rate policy and other monetary tools. While intended to stabilize prices and growth, this authority goes beyond mere macroeconomic management, extending influence into financial markets, business decisions, and the overall path of prosperity. Recent actions like keeping borrowing costs high reflect an attempt to rein in inflation, yet simultaneously risk damping activity in sectors reliant on affordable credit like construction and technology.

The Federal Reserve’s Extensive Reach

At the core of the Federal Reserve's power is its sway over interest charged and quantitative easing. By adjusting the federal funds rate, the Fed impacts the expense of loans for individuals and companies, shifting outlays, investments, and total output. For example, maintaining present high rates targets inflation but heightens financing costs, potentially slowing expansion and affecting land and tech which depend on cheap funds. Furthermore, massive bond purchases to inject liquidity, while stimulating demand in downturns, also fosters asset inflation favoring stock and property owners and exacerbating inequality of wealth.

Political Influence

Economic plans are heavily shaped by political motivations, often prioritizing temporary benefits over lasting stability. For instance, fiscal strategies like tax reductions or expanded public spending frequently aim to perk up the economy, notably in election years regardless of the long-term implications of swelling deficits and accumulating national debt. The Biden administration's policies including substantial infrastructure investment and social programs likewise illustrate how partisan goals can form fiscal policies and consequently economic conditions.

Furthermore, political influence reaches far into regulatory systems shaping the climate for emerging technologies. Rules for cryptocurrencies stem from safeguarding consumers and preserving stability, though overbearing oversight may thwart innovation and cap crypto's potential. The SEC's actions against select exchanges and initial coin offerings exemplify tensions between authority and liberty.

Regulatory obstacles and market manipulation often serve broader aims. After 2008's crisis, Dodd-Frank mandated oversight reducing systemic risk, an important yet costly imposition. Cryptocurrency measures proved even stricter following high-profile thefts and failures fueling demands for stricter rules worldwide. However, prohibitive policies hinder creation, and an excessively regulated environment deters newcomers from pioneering advances.

The interplay of governmental muscle and market forces weaves a intricate landscape where choices absorb political considerations, at times prioritizing those with influence over decentralized alternatives able to flourish freely. How 2024 unfolds will illuminate the true expense of concentrated control on traditional and digital finance alike. As human ingenuity navigates these dynamics, may cooperation prevail over inhibition in shaping governance supportive of progress.

The Struggle for Decentralization in Finance

Building upon penetrating insights into authoritarian sway over fiscal policy, we redirect our focus to the fundamental battle for decentralization within the financial sector. This portion explores how digital monies embody the virtues of decentralization and the myriad difficulties they face from entrenched directives and political motivations.

Cryptocurrency and Distributed Governance

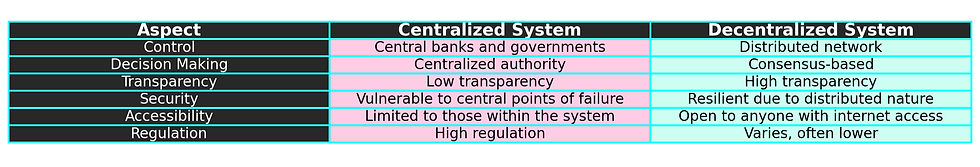

At the nucleus of the cryptocurrency movement lies the philosophy of decentralization. Digital monies like Bitcoin and Ethereum run on decentralized networks, where transactions are corroborated by a diffuse system of nodes rather than a central body. This model pledges elevated transparency, reduced chance of deceit, and fortified security. The distributed nature of cryptocurrencies is essentially intended to bypass conventional financial intermediaries and elude the drawbacks of centralized oversight.

The charm of decentralization is not merely theoretical, evidenced by its practical response to systemic risks and ethical shortcomings discerned within centralized finance. The reckless lending and inadequate oversight fueling the 2008 crisis demonstrated centralized institutions' vulnerabilities. In contrast, blockchain's immutable, transparent transactions governed by code rather than fallible humans offer an alternative, as seen in cryptocurrencies.

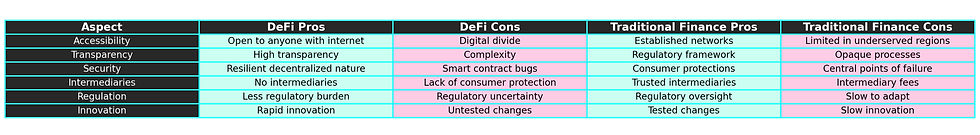

Regulatory Hurdles While possessing potential, cryptocurrencies face substantial regulatory hurdles threatening progress. Governments worldwide adopted varied regulation of digital assets, from outright bans to rigid frameworks. Regulations often center on deceit, money laundering, and stability concerns. However, such measures also represent controlling finance and preventing decentralization represented by cryptocurrencies. For example, within America the stringent SEC regulates ICOs and exchanges through aggressive enforcement. While safeguarding investors, uncertainty created discourages proper technological advancement. Correspondingly, the EU introduced MiCA seeking harmonization across members but imposing rigorous demands small players may struggle satisfying.

The Central Banks' Influence Reaches Crypto Markets

Central banks' sway extends beyond traditional financial markets into the realm of cryptocurrencies. As mentioned earlier, the Federal Reserve's monetary steps can notably impact investor behavior and market dynamics. For example, when raising interest rates, traditional banking instruments appearing more attractive can prompt investors to depart from more volatile holdings like cryptocurrencies. Conversely, low rates may spur investors toward crypto assets hunting higher returns.

This interplay spotlights decentralized markets' vulnerability to centralized economic policies. While possessing a decentralized nature, cryptocurrencies do not function isolated. They participate in the broader financial ecosystem and encounter the identical macroeconomic factors influencing standard markets. This dynamic births a complex landscape where decentralized holdings remain susceptible to ripple effects from centralized decisions.

The Struggle for Financial Self-Governance

Proponents of cryptocurrency argue that decentralization provides benefits beyond monetary modernization. They envision decentralized finance (DeFi) as a route toward enhanced economic independence and populace governance. In a system without centralized control, individuals retain more authority over their assets, decreased reliance on conventional banking, and amplified access to financial services. This perspective contrasts sharply with the current framework, where small groups wield outsized financial clout.

The campaign for decentralization is not solely a technical dispute but also an ideological one. It disputes the status quo of financial administration and aims to redistribute authority more evenly among society. However, achieving this vision necessitates surmounting sizable regulatory barriers and persuading policymakers to adopt a more receptive stance toward financial ingenuity. The ongoing tension between oversight and the freedom to pioneer will shape the future of both traditional and decentralized monetary platforms.

Resolution

In conclusion, while cryptocurrencies proffer a promising substitute to centralized monetary systems, they face substantial difficulties from present regulatory rules and economic policies. The struggle for decentralization continues and necessitates a delicate balance between ensuring financial stability and nurturing innovation. As the global economic landscape evolves further, the discussion between central authorities and decentralized networks will play a pivotal role in forming the future of finance.

Case Studies and Historical Examples

Exploring decentralization's ongoing struggle within finance necessitates examining pivotal cryptocurrency events illuminating today's complex regulatory landscape and investor sentiment. This section analyzes formative periods shaping rules while offering deeper insight into decentralized finance's current state.

The Collapse of Mt. Gox and Regulation's Evolution

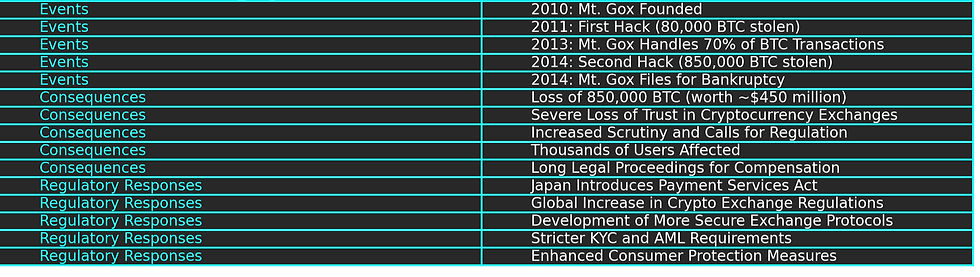

2014 saw one of cryptocurrency's most defining moments when hackers looted approximately 850,000 Bitcoins from once-largest exchange Mt. Gox, damaging confidence and fueling calls for oversight. This highlighted vulnerabilities within the nascent market, underscoring security and monitoring necessities.

Governments subsequently strengthened regulatory roles. America introduced measures against fraud and noncompliance via the SEC and FinCEN, aiming protection while potentially hindering sector innovation. Compliance burdens challenge growth yet safeguard the unsuspecting.

ICO Booms and Their Aftermath

2017-2018's initial coin offerings further complicated regulation. Providing startup funding through custom tokens, this method democratized capital sources yet cultivated deception and bubbles. High-profile failures costly investors dearly and intensified administrative scrutiny.

In response, regulatory bodies like the SEC cracked down on ICOs violating securities laws with crushing force. This sent shockwaves through the market, drastically reducing ICO numbers and propelling a shift to more regulated fundraising like Security Token Offerings and Initial Exchange Offerings. These developments showed regulators must deftly balance protecting investors while nurturing innovation.

Recent Regulatory Events

Ongoing changes continue molding cryptocurrency regulation. The Markets in Crypto-Assets regulation aims creating harmonized European Union digital asset rules, yet stringent demands on crypto businesses risk hampering growth and nimbleness.

In America, the Biden administration evidently desires a comprehensive cryptocurrency regulation approach addressing financial stability, consumer protection, and illegal behavior concerns. The proposed Digital Asset Market Structure and Investor Protection Act seeks establishing exchange rules and boosting crypto market oversight, for example.

The Part Played by Centralized Exchanges

Centralized cryptocurrency exchanges serve crucial roles in the crypto ecosystem, facilitating trading and supplying liquidity. However, they also epitomize centralization vulnerabilities to regulation pressures and security breaches, as demonstrated by the infamous Mt. Gox hack and recent Binance and KuCoin incidents.

In contrast, decentralized exchanges offer a more secure alternative, allowing peer-to-peer trades without intermediaries. While DEXs align with decentralization principles, they face challenges involving liquidity, usability difficulties, and legal compliance.

Conclusion

The tumultuous history and ongoing transformation of the cryptocurrency sphere underscore the perpetual struggle between decentralization and oversight. Pivotal events like the collapse of Mt. Gox and the frenzied ICO period have shaped regulation, highlighting the necessity of a balanced approach that safeguards investors while cultivating innovation. Moving ahead, dialogue between watchdogs and the crypto community will be imperative to navigating the complex interplay between centralized control and decentralized freedom of choice.

The 2024 Economic Outlook and Crypto Markets

The decentralized finance sector faces many uncertainties in 2024 according to economic forecasts. Analysts disagree whether strengthening or weakening will define conditions globally with issues like geopolitical tensions, lingering pandemic effects, and persistent inflation affecting outcomes variably by region. Inflation, a chief worry for policymakers and investors, may moderate overall but inflation rates will diverge significantly between advanced economies expecting relief and emerging markets continuing struggles with high prices. The U.S. Federal Reserve's tactic of interest rate adjustments to tame inflation carries immense impacts for financial markets since cryptocurrencies closely track swings in conventional assets.

Maintaining elevated interest rates into mid-2024 intends deflating inflation but risks are not insignificant. A higher cost of borrowing can dampen business spending and consumer outlays, sucking oxygen from growth. For cryptocurrencies specifically, tightened financial conditions may channel investors toward reliable yield-generating securities like bonds, reducing market liquidity. However, vibrant decentralized applications and emerging use cases may counteract these forces to some degree, offering rare glimpses of optimism amid a clouded forecast.

Geopolitical Factors and Technological Disruptions

Geopolitical tensions and technological advancements will influence the global economy and crypto markets in complex ways. Disputes between major powers like the US and China continue, impacting trade, regulation, and strategic competition over critical industries. These tensions affect supply chains and global capital flows, risking volatility for cryptocurrencies reliant on widespread liquidity and confidence. AI's accelerating development profoundly transforms how we work and live, birth both opportunities in new industries and challenges regulating job disruptions. For crypto, AI enhances security and trading yet requires adaptation to emerging rules managing emerging risks.

Investor Sentiment Amid Macro Shifts

The cryptocurrency outlook faces uncertainty as macro factors pull markets in opposing directions. On one hand, inflation and geopolitical risk may drive crypto as alternative stores of value against volatility. Yet on the other, interest rate increases and regulatory crackdowns could curb institutional appetite favouring lower risk. Overall, sentiment proves highly sensitive to economic signs and announcements - positive data like stable prices or growth lifts confidence in risk assets while negative news such as rate hikes or conflicts triggers sell offs and swingings. Adaptability to shifting macroeconomic and policy landscapes will influence industry development.

The interplay between traditional finance and cryptocurrencies remains crucial as we move forward. As noted before, central bank actions, especially from the Federal Reserve, significantly impact liquidity and investor behavior in the crypto markets. For example, should the Fed signal lowering rates in the second half of 2024, this could trigger a surge in cryptocurrency investments as risk-takers hunt returns.

Regulation Developments

Clear, consistent regulation is required for long-term cryptocurrency market growth. Recent government attempts to enact frameworks like the EU's MiCA and proposals in the US aim to safeguard consumers while enabling innovation. However, balancing regulation with maintaining cryptocurrencies' decentralized nature stays challenging.

Wrapping it up

As 2024 approaches, the intricate interplays between financial predictions, geopolitical tensions and shifting regulations pose a fork in the road for the cryptocurrency marketplace. Grasping these dynamic forces is pivotal for investors and other stakeholders hoping to navigate crypto's volatile yet promising decentralized finance wilds. Ongoing discussions between watchdogs and the crypto community will greatly impact this emerging sector's future path, balancing demands for advancement alongside priorities of fiscal accountability.

Towards a Decentralized Hereafter of Financing

Building upon analyses of economic trends and their implications for digital monies, contemplating the trail ahead for decentralized financing is imperative. This portion ponders how stakeholders can maneuver within regulatory environments, advocate for autonomy, and cultivate innovation in alignment with principles of self-direction and safeguarding interests.

Advocacy in Pursuit of Autonomy

The effort to decentralize money stems not just from technical progress but from a philosophy grounded in economic liberty, transparency, and empowerment. Proponents argue that a decentralized system mitigates risks inherent in consolidation and enables individuals by affording greater oversight of their assets. To further these ideals, it is crucial for decentralized finance (DeFi) supporters to actively join in discourse with watchdogs and policymakers.

This involves educating all parties about the advantages of decentralization, like enhanced security via blockchain technology, reduced reliance on intermediaries, and amplified privacy for users. By fostering deeper understanding of these benefits, DeFi advocates can help shape guidance that safeguards consumers without suppressing novel approaches.

Policy Recommendations

Creating a balanced regulatory environment that fosters both oversight and innovation is essential for the long-term sustainability of the cryptocurrency market. The following suggestions seek to accomplish this elusive equilibrium: Cohesive, predictable rules would supply consistent principles pertinent universally, diminishing uncertainty and permitting ventures to arrange with self-assurance.

The expansive approximating propelled by the European Union known as MiCA is progress towards a synchronized procedure for crypto-resource administration between participating nations. Furthermore, localized experimentation with tailored policies could provide learning opportunities to find innovative approaches balancing interests until overarching harmonization is achieved. Carefully constructed public-private partnerships allow nuanced needs across diverse communities to be represented for balanced policy shaping addressing all perspectives.

Establishing regulatory sandboxes allows experimentation under controlled conditions with temporary exemptions from rules. This encourages testing of novel products and services while facilitating watchdog comprehension of evolving technologies prior to broad application of laws.

Given cryptocurrency markets span the globe, coordination among international regulators is imperative. Harmonizing transnational rules can curb regulatory arbitrage while ensuring an even playing field for companies operating in multiple nations.

Regulations should be proportionate to the varied risks inherent in different digital assets. For example, stablecoins pegged to fiat currency may warrant discrete treatment compared to highly volatile cryptocurrencies like Bitcoin.

Fostering Progress in Cryptocurrency

The cryptocurrency realm should motivate advancement through encouraging policies and framework development. Administrations and private ventures can collaborate to form an environment that nurtures scientific headways while guaranteeing security and agreement.

Financing in Blockchain Exploration: Governments can subsidize inquire about into blockchain innovation to investigate its potential applications past digital forms of money, for example, inventory network administration, computerized character approval, and keen contracts. Government subsidizing of college blockchain examines can drive development.

Coordinated Efforts: Connections between the public and private segments can fuel development in the crypto space. As an example, coordinated attempts can zero in on creating secure and scalable blockchain foundation, improving cybersecurity measures, and making instructive programs to assemble a gifted workforce. Joint efforts among organizations and colleges can give understudies openings to apply their blockchain learning.

Urging Financial Incorporation: Cryptocurrencies have the potential to further financial incorporation by giving access to monetary administrations for underserved populaces. Approaches that advance the utilization of computerized resources in remittances, miniature fund, and same level lending can help accomplish more extensive monetary incorporation. Crypto-based gifts and credits could assist underprivileged networks with admission to funds.

As we take a gander toward the future, the connection among administrative oversight and the standards of decentralization will shape the trajectory of the digital money advertise. By pushing for adjusted principles that ensure shoppers while urging headway, partners can navigate the mind boggling scene of decentralized fund. The consistent discourse between controllers, pioneers, and the more extensive monetary group will be basic in guaranteeing that the advantages of decentralization are understood, at last driving to a more clear, incorporative, and tough monetary framework.

The excursion toward a decentralized budgetary future is loaded with difficulties, yet with strategic advocating, thoughtful strategy making, and a responsibility to advancement, it is conceivable to make a budgetary biological system that truly empowers people and upgrades monetary opportunity.

Cypher University and the Pivotal Role of Education in Decentralization

As we gaze towards the coming possibilities of decentralized finance, education's role in cultivating a decentralized community free of governmental manipulation becomes increasingly imperative. Cypher University stands on the cutting edge of this pedagogical revolution, aiming to empower individuals with the sagacity and abilities necessary to thrive in the decentralized economy.

The Mission of Cypher University

Cypher University is more than just an academic institution; it embodies a commitment to comprehending and navigating the intricate nuances of the digital asset ecosystem. With a mission to illuminate and elevate, Cypher University has designed an innovative curriculum that demystifies convoluted cryptographic concepts, providing students with a profound grasp of blockchain technologies and their vast potential uses.

The Founder's Vision

The founder of Cypher University stresses, "I established Cypher University because I believe in making the power of decentralization and crypto accessible to all. It’s not just about technology; it’s about empowering people and showing them that this financial revolution is already underway. We’re all part of it, and I want everyone to feel included and confident in this new world."

Promoting Financial Freedom Through Education

Pedagogy at Cypher University is centered around the principles of decentralization and financial liberty. The university offers comprehensive courses on various facets of cryptocurrency and blockchain, designed to provide both novices and seasoned aficionados with the tools they need to navigate and innovate within the digital economy.

The Unsexy but Critical Role of Education

True decentralization demands more than advances in technology alone; widespread comprehension and involvement is imperative. Education, often viewed as unexciting and unwanted, forms the cornerstone of transformation. Without solid instructional foundations, the decentralized community cannot achieve its full potential. Cypher University recognizes this crucial role and aims to make learning engaging and accessible, understanding that education unlocks the path to genuine decentralization.

Realizing Blockchain and Crypto's True Capability

A primary goal of Cypher University focuses on moving beyond cryptocurrencies as mere speculative vehicles or tools for deception. The curriculum emphasizes practical applications of distributed ledger technology across sectors such as finance, healthcare, and pedagogy. By spotlighting real-world uses and success stories, Cypher University strives to demonstrate decentralized technologies' transformative might.

Establishing a Decentralized Educational Network

Cypher University aims to cultivate a global community of students, teachers, and professionals who cooperate on initiatives, exchange ideas freely, and interrogate the constraints of distributed systems. This societal method not only improves educational outcomes but fosters an empathetic environment where continuous progress and innovations within the domain of blockchain technology can flourish.

The university hopes to forge alliances across geographical and cultural boundaries, facilitating collaboration between diverse viewpoints and pooling resources to address complicated issues. By prioritizing open access and democratic decision-making, Cypher University strives to establish an inclusive framework for distributed learning that leaves no member of the community behind.

Empowering Individuals and Safeguarding Freedom

With an emphasis on cybersecurity and conscientious participation, Cypher University equips students with knowledge to protect their digital assets and engage in the crypto market responsibly. By teaching individuals best practices and risk management strategies, Cypher University aids development of a resilient and secure decentralized community.

Cypher University unquestionably assumes a crucial part in mankind's relentless quest for a decentralized economic system of the future. By giving easily available, far-reaching training on blockchain innovation and computerized monetary standards, it furnishes people with the devices expected to take authority of their own financial destinies and add to a more straightforward, comprehensive, and cutting edge monetary framework. As we continue investigating the interplay between oversight and decentralization, the significance of an educated network that sees both the development and hindrances ends up noticeably basic.

Through its mission and projects, Cypher University is breaking trail for a decentralized insurgency in training conveyance and monetary turns of events, demonstrating that training, frequently underestimated, is the establishment upon which serious decentralization can and will be worked. Meanwhile, additional work stays to be done. If the guarantee of an impartial, open, and straightforward economy is to be acknowledged, associations like Cypher University should keep on filling in as a wellspring of ability that urges and encourages dynamic cooperation in the making of tech that can drive social change.

Wrapping it all up in one go

This critique underscores centralized influence over financial structures, especially via central bank actions and administration guidelines, and highlights the pivotal requirement for decentralization to cultivate fiscal autonomy and progress. Here, we reinforce opposition to concentrated oversight and emphasize decentralized finance's transformative potential.

The Overreach of Centralized Economic Mandates

Central banks, particularly the Federal Reserve, wield immense authority over the economy through financial policy. Interest rate and quantitative easing choices are often made by a select few and significantly impact worldwide markets. These strategies, supposedly aimed toward preserving economic stability, regularly prioritize large financial institution and affluent individual interests over broader populace needs. The manipulation of credit situations and management of swelling targets function to sustain a status quo benefitting massive banks and wealthy persons, while frequently sidelining overall economic demands.

Centralized economic directives have historically led to substantial economic disruptions. The 2008 fiscal crisis, a direct consequence of reckless lending practices and insufficient regulatory monitoring, necessitated massive administration intervention to stabilize the situation. This intervention, while necessary, entrenched central bank power and increased their oversight of the economy. Such precedents illustrate the dangers of concentrated economic control and the risks of moral hazard, where entities take on excessive risks, understanding they will be bailed out.

Government oversight of cryptocurrencies, while often intended to safeguard consumers, can stifle burgeoning technologies and curb the development potential of decentralized finance. Regulators' reactions to events like the Mt. Gox hack and boom in initial coin offerings have instituted compliance burdens that most heavily impact smaller actors and new market entrants. These regulations frequently reflect a longing to maintain authority over monetary systems and thwart the decentralization that cryptocurrencies represent.

The regulatory panorama is regularly molded by political motivations, further complicating the ever shifting political tides continually mold the regulatory terrain, further complicating the development of an equitable and open economic infrastructure. Nominally impartial administrative agencies, swayed by partisan pressures, often enact provisions favoring established fiscal heavyweights while erecting barriers to decentralized options. This preferential treatment of centralized oversight undermines the foundational philosophies of blockchain technology, aiming to spread access to economic opportunities more widely across the population and lessen reliance on centralized intermediaries.

Decentralized finance (DeFi) provides a compelling alternative model to the traditionally centralized fiscal framework. By capitalizing on the capabilities of blockchain technology, DeFi platforms can deliver transparent, secure, and accessible monetary utilities sans conventional facilitators. This scheme advances financial inclusion and empowers individuals by affording them enhanced oversight of their assets. However, the full potential of DeFi will only be realized if the regulatory environment cultivates innovation rather than constricts it.

Education plays a pivotal role in advancing the principles of decentralization. Organizations like Cypher University are integral in this regard, supplying comprehensive education on blockchain and cryptocurrency. By equipping individuals with the comprehension and abilities to navigate the decentralized economy, Cypher University fosters a community that values fiscal autonomy and questions the status quo of centralized oversight.

The call to action cannot be ignored if true change is to arrive. Centralized powers have reigned far too long, stifling innovation and community. Now is the moment for advocating balance - regulations that shelter people while seeds are sown. Financial knowledge must spread far and deep so each soul grasps what decentralized means: transparency not tyranny, a hand for all not some. Initiatives arise showing a future where decentralized dominates.

Ongoing talks between regulators, pioneers, and all with stake in finance will sculpt tomorrow. Critique of central control stays center as this complex road is navigated. Decentralized blessings bloom if its benefits are realized, cultivating an economy where all may grow equitable and free. The dialogue must diligently difference new from old, prizing what empower and shun what smother, so destiny takes a shape where community commands but none are commanded.